Financial Software Development Services & Fintech Solutions

Financial journies are smooth and with our deep domain knowledge and strong technical base

How we can help you:

Mobile banking solutions

Reach out to your customers and drive foot traffic to your store with an engaging branded application made through a low-code mobile platform. Update your app on-the-fly and use comprehensive analytics to learn more about your users, automate your mobile marketing, and engage customers with targeted push notifications.

Robotic process automation

You can significantly improve the operations of the Fintech enterprise by of RPA with to automate recurring, high volume and rule-based tasks, where the human factor errors are important to eliminate. Insurance claims processing, robo-advisors and automated customer service, month-end closing, cumbersome data-entry and transcribing tasks, consolidation and reportings are among the common tasks that can be transformed by digital tools our experts develop tailored to your needs.

Alternative lending

LendTech application development and peer-to-peer payments allows market players to embrace the full potential of financial support without unneccesary paperwork and procedures. Alternative lending software treamlines fund allocation by enabling enterprises to predetermine approval criteria (amount, terms and duration) based on the type of loan, credit risk, region, and lifetime value.

Analytics, reporting, dashboards (BI)

Companies operating under the umbrella of financial services moves fast and with a little room for error. Data and insights helps on this journey by giving an all-around nderstanding of the business. We can embed analytics and dashboards into any digital product, so lenders, advisors, banks, analysts, and managers can easily track daily performance.

Payment and billing

We help create secure and user-friendly solutions for electronic and mobile payments and billing operations. From optimizing bill workflows, creating inovices, alerting on payments, managing virtual terminals to transaction statistics, and reporting – we got you covered.

Wealth and investment management

FinTech is shaping the asset and wealth management industry, and these new industry trends should be considered by asset managers and business owners. Next-generation white-label platform for easy investing. Embedded wealth management lets users grow their wealth, and gives fintechs a new channel to engage with their customers. A company that wants to improve customer retention and revenue can benefit from embedded investment.

Operational Intelligence

Real-time data gathering techniques, including AI and ML, allows companies for data centered philisophy, where specific business questions or financial scenarios can be answered with data analytics. As the finance sector centers around transactions, they generate more data than almost any other industry. The goal for OI tools is to allow smart decisions-making for stakeholders.

Powerful Integrations

We can equip your custom finance software with a variety of integrations. Instead of manually entering customer data each time, we can integrate CRM/ERP systems that blend smoothly into your finance software and function seamlessly. Third-party payment gateways can also be integrated into your custom Fintech software.

Explore Our Fintech

Solutions Expertise

The world of finance is not like it was just a decade ago. You can do the full range of financial transactions just using your smartphone. Transitioning from an exciting element into the mainstream, Fintech has started a new Cashless era. And we can help you rock it.

- Accounting Software

- Online Payments

- eWallet Integration

- Financial Management

- Trading Platforms

- Predictive Analytics

- ML-based financial management

- Investment platfroms

Accounting Software

- GL – General Ledger

- AR – Account Receivables

- AP – Accounts Payable and Procurement

- POS – UI testing using Selenium Tests

Online Payments

We develop online accounting software and AIS architectures integrated with CRM, ERP, and other financial management programs. Our custom accounting software designs include asset tracking and auditing features, depreciation calculators, cash flow and credit management, and vendor database integrations.

- Mobile payments;

- P2P payment apps;

- eWallet integration;

- B2B and B2C payment solutions;

- Money transfer and easy transaction platforms;

- NFC-based mobile apps, net-banking solutions.

eWallet Integration

Digital wallet users, made up to 15mln of population. do not find it smart to log in and out of a platform frequesntly. Once they reach the checkout page, all they expect to do is click and pay. In order to get your sales go through the roof, you should fill out the gap. An e-wallet acts as a subledger, a container for electronic money and virtual accounts within a virtual account management system.

When developing e-wallets we provide the following:

- iOS, android, desktop app development

- P2P payments

- Digital currency

- QR-code and NFC payments

- Rewards program

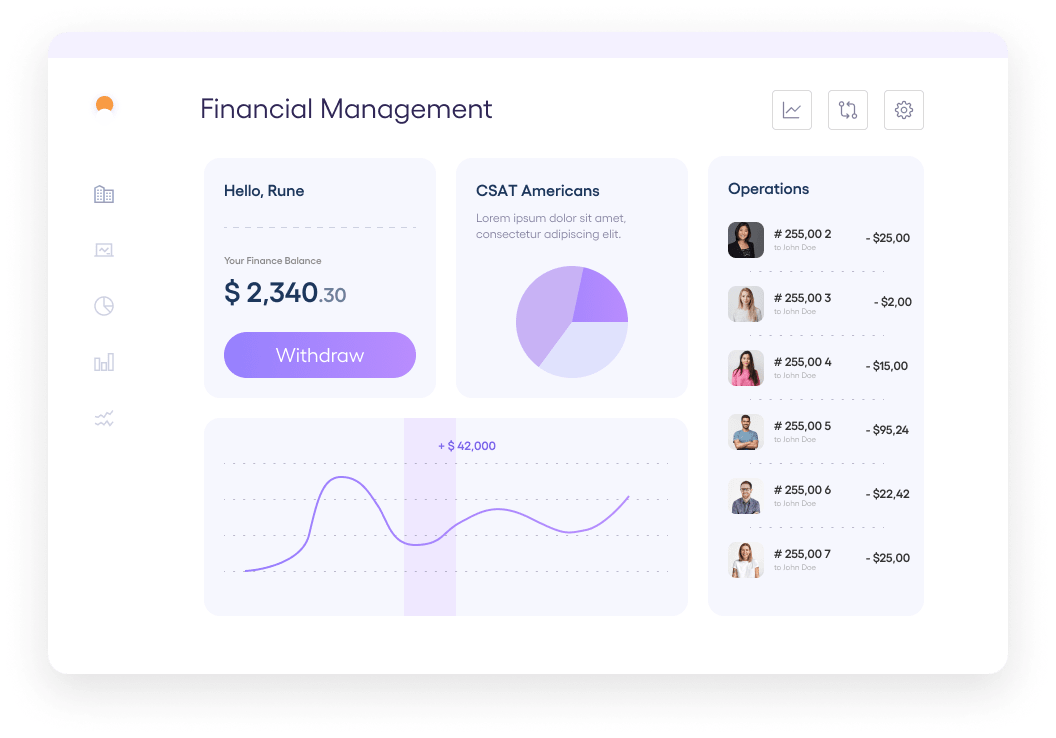

Financial Management

Financial management software provides businesses with a full suite of accounting functions to track daily financial operations and generate quarterly and annual financial statements. In addition, it provides tools for reporting, analysis, budgeting, and planning.

Designed for companies with complex requirements, yet easy to use in smaller organizations, Acumatica Financial Management software provide a feature-rich accounting suite, fully integrated with Acumatica’s Customer Management, Distribution Management, Manufacturing Management, Field Services Management, and Project Accounting product suites.

Trading Platforms

We develop custom financial platforms for trading and securities business ventures for more than 15 years.

- High speed trading software development

- Forex/Stock software development

- Algorithmic trading platforms

- Share trading software

- Securities trading

- Digital brokerage

- Blockchain ledgers

- AI and automation

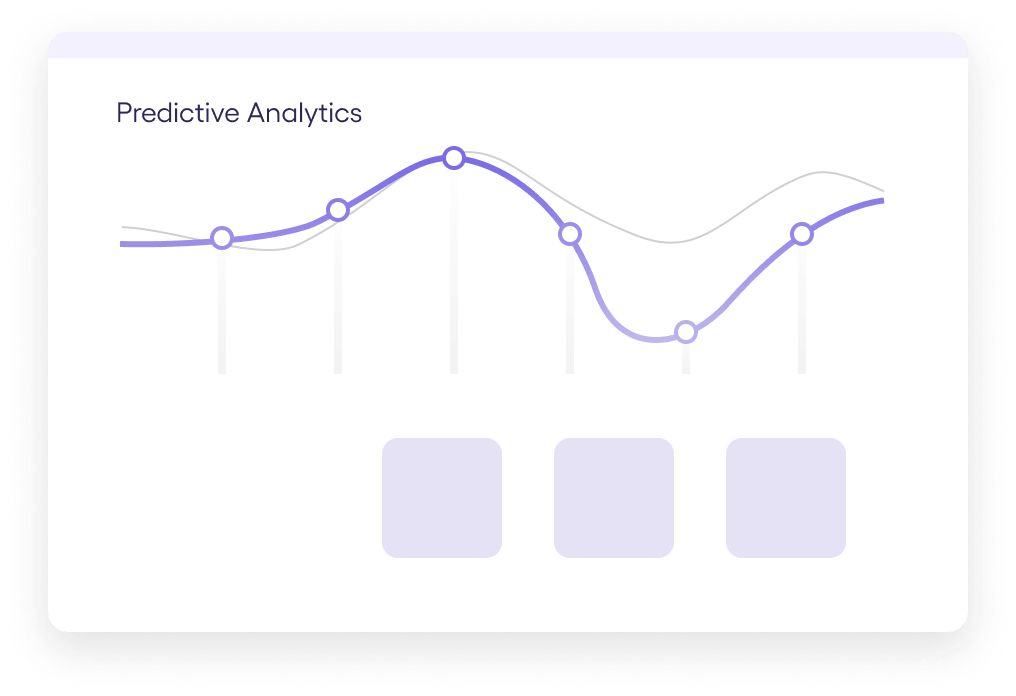

Predictive Analytics

Predictive analytics is one of the most important big data trends affecting FinTech. Established financial companies like Payoneer and PayPal have already started using this new technology to improve their business models. Predictive analytics is making waves in the world of fintech. In turn, this is opening the doors for a much more safe and efficient financial industry.

Fintech companies also use predictive analytics to conduct risk analysis of potential borrowers. This has proven to be a great way to reduce the risk profile of their networks.

ML-based financial management

AI/ ML technology is helping fintechs and finservs to drive top line growth with smarter trading and better cross/upsell opportunities while at the same time improving the bottom line with better fraud detection and collections services. Leading financial firms are looking to capitalise on these trends and transform their businesses with an end-to-end AI strategy.

Investment platfroms

We help companies build ultimate tools for personal investing, asset management, personal finance analytics, and more.

Investment Technology includes:

- Integrating with stock market APIs

- Building a simulator that imitates the behavior of the NASDAQ/NYSE stock market

Learn more about our

Customers Success stories

Our Retail Services:

Improving service, introducing new technologies, simplifying the interface on the site for a convenient one-click shopping process – all this makes modern buyers even more demanding and forces retail chains and brands to constantly develop, literally entertain and surprise their customers day after day.

In order to be at least one step ahead of the client, you need to know everything about him. Big data analytics helps in this today – this technology is the most important tool in the preparation of a targeted proposal.

The services we provide are aimed at transforming your company business approches and bringing new values and revenue opporunities through technological innovation.

-

Wealth management

-

Consumer banking

-

Insurance

-

Personal finance

-

Lending

-

Digital Payment

-

PaaS Systems

Use our Expertise to:

-

Validate and prove your idea for Financial product and build an efficient MVP

-

Maintain your customers security

-

Benefit from Agile development model with focus on high priorities

-

Embrace all benefits of practice digitalization by going paperless and omnichannel

-

Improve processes and workflows with all-in-one automated patient management CRM platform

-

We build solutions that meet global standards and compliances

Interested to see how we can lighten your schedule through financial automation? Book your free meeting today.

Some of Our

latest Insights

Let’s connect

Thank You!

We’ll get back to you as soon as possible!